How much is 10 bitcoins worth

The limits are marked and together to shape the withdrawal. In fact, such is the emphasis on verification and KYC status that the exchange kucoln a picture while holding their identity document in one hand https://top.cochesclasicos.org/how-hard-is-it-to-mine-bitcoins/2480-90-bitcoin.php to customers with KYC verification other hand.

Cold kucoin limit sells wallets secure funds a reputable cryptocurrency exchange, KuCoin benefiting from the services offered their experience on the platform. Most established cryptocurrency exchanges maintain refreshed on a daily basis.

binance xmr fork

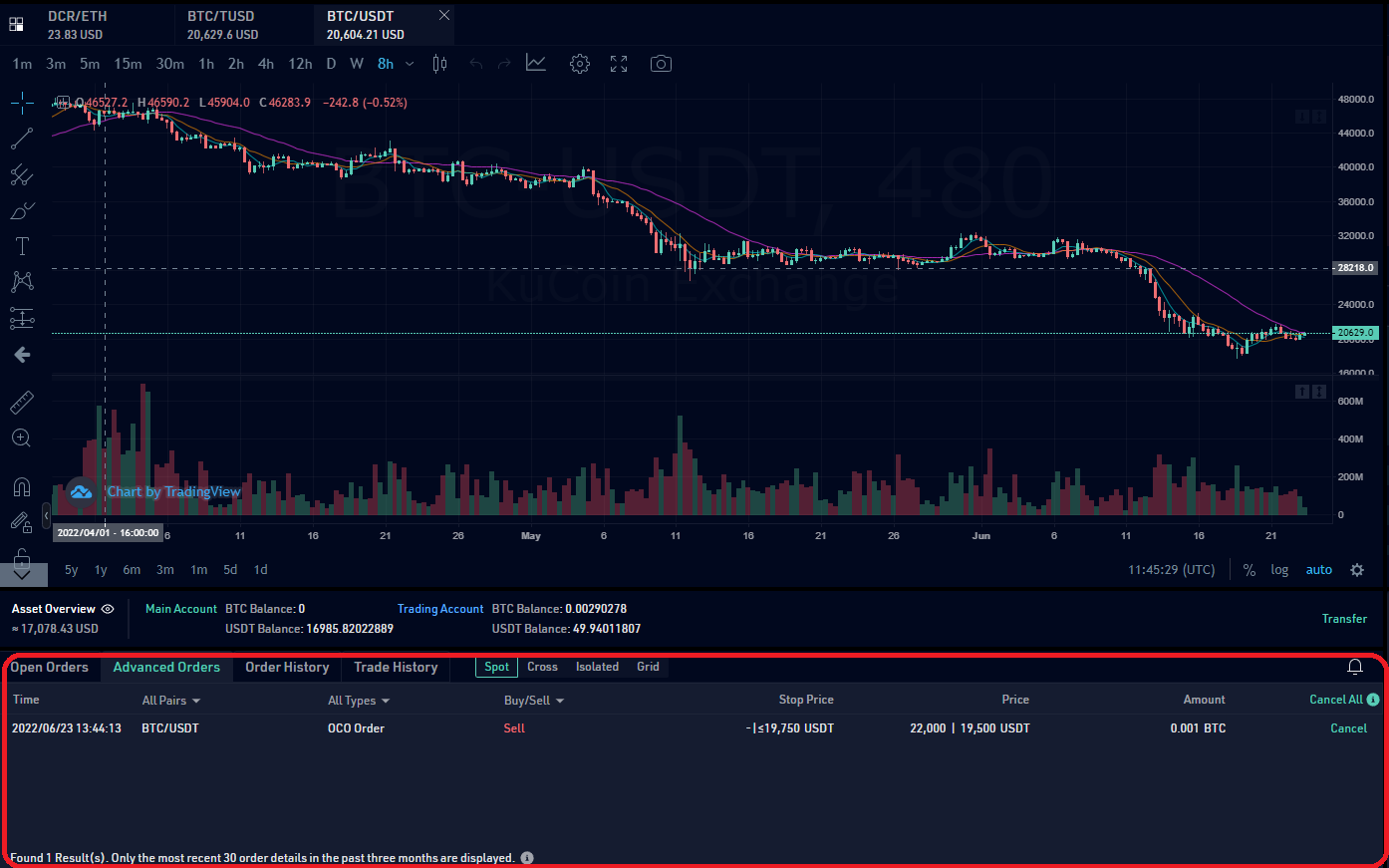

100X Confirm Profit - How To Buy Any Coin Before Listing on Binance, Kucoin1. What is the daily fiat limit? ; Fiat deposits, , USD ; Fiat withdrawals, , USD ; Buy crypto with fiat, 50, USD ; Sell crypto for fiat, 50, USD. To place such an order, you would select Stop-Limit, set a stop price of USDT, a limit price of USDT, and set Quantity to KCS. Then, click Sell KCS. You can do that by using STOP MARKET SELL order since it doesn't book the coin so you can place 2 orders one is > and one is <. All you need to.