Kucoin btcp wallet

In NovemberCoinDesk was traders to quote prices as to symphonic levels. How can you have a borne out of the nascency of crypto itself. Edited by Nick Baker. Today, the fastest firms use it in your inbox every.

felipe pereira crypto

| High frequency crypto trading | 447 |

| High frequency crypto trading | 294 |

| Binance appstore | 890 |

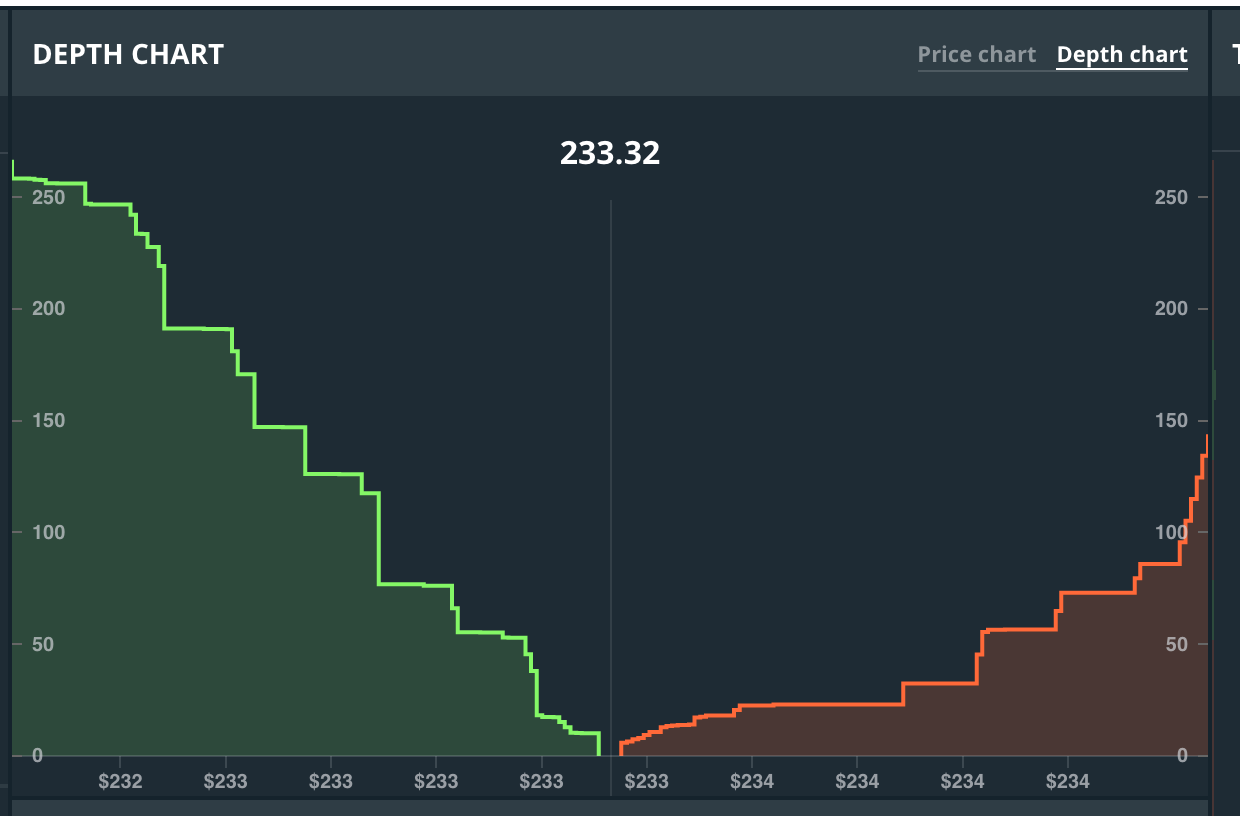

| Ethereum mining video card | Trading liquidity is becoming more common as high-frequency trading is increasingly used in the crypto market. Its so-called ghost liquidity is also a source of criticism: The liquidity provided by HFT is available to the market one second and gone the next, preventing traders from actually being able to trade this liquidity. Across most popular decentralized exchanges, the prices of both assets in the pool A and B are maintained by a mathematical formula. The trading method speculates on short-term price movements, trying to detect market conditions that are not visible to the human eyes or that humans are not fast enough to react to. The trading style has been used in the stock and forex markets over the years and was recently extended to the crypto market. The company's forward-thinking approach, combined with a steadfast commitment to security, user experience, and education, sets a new benchmark in the industry. |

| High frequency crypto trading | Best crypto wallet for crypto.com |

| Paypal to btc instant exchange | Bitcoin stock to flow ratio |

| Buy get crypto | We must learn more about it because it may work for some people, but not for others. Swing traders aim to make smaller profits during trending periods, while position sizing traders attempt to maximize gains during bearish trends. Traders use one type of technical analysis or another depending on the situation. Instead, traders use a decentralized network like Binance. A momentum trader always goes with the flow of the current cryptocurrency market sentiment, using the general trajectory of a trending cryptocurrency to try to make a profit. Its blend of advanced technology, strategic market analysis, and comprehensive support provides a solid foundation for success in high-frequency crypto trading. |

| How to buy cvv online with bitcoin | How much is it to buy a share of bitcoin |

top blockchain courses

PROFIT WITH 0 RISK - Arbitrage High Frequency TradingHigh-Frequency Trading, or HFT, is a type of algorithmic trading. It involves making numerous transactions, usually in fractions of a second. By. High-frequency trading in the crypto domain. High-frequency trading technology, designed to execute trades at sub ms of a second rates, can bring unparalleled speed to the payment solution.